Many Caribbean countries risk becoming COVID-19 economic long-haulers. Much the same as some patients could suffer from lingering illnesses long after the corona virus infection has passed, the pandemic’s economic fallout might be felt in the region long after the health emergency is controlled.

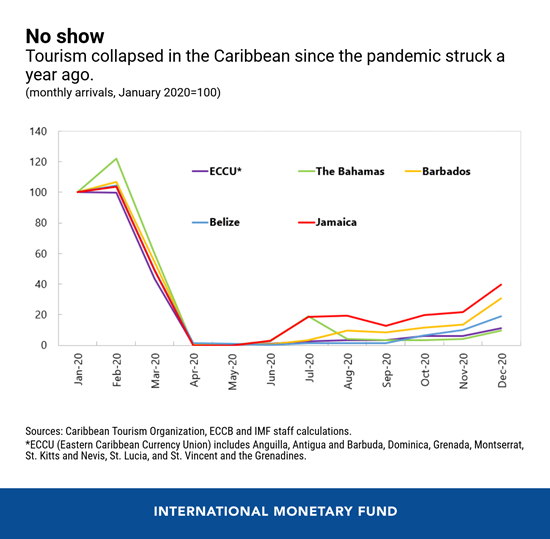

The reason is that most of its countries rely heavily on tourism. Due to their small size and limited room for maneuver, Caribbean economieswere among the most affected by the pandemic. With annual hotel stays plummeting by 70 percent and cruise ship travel completely halted, tourism-dependent countries contracted by 9.8 percent in 2020. Commodity exporters in the region (Trinidad & Tobago, Suriname, and Guyana) were less affected and saw a mild contraction of 0.2 percent.

Second wave

Most Caribbean countries managed to contain the virus’ spread initially, and reopened to international travelers in the second half of 2020. But renewed waves of infections and travel restrictions in the countries where most visitors normally come from (US, UK, and Canada) have put a much hoped-for tourism rebound in check.

This could lead to significant long-term scarring: loss of jobs hitting mostly youth, women, and less educated workers; increases in poverty and inequality; potential closings and bankruptcies of hotels, resorts and associated tourism services (restaurants, shops and tour operators); fewer flights to and within the region as airlines struggle to recover; and loss of global ‘market share’ if cruise operators permanently reroute ships to other destinations.

Financing gap

The international community has delivered substantial financial support to help the Caribbean fund unprecedented public spending needs. This support helped alleviate near-term pressures, but many countries still face a gap due to growing fiscal deficits and tightening borrowing conditions as the crisis persists.

Assuming no new external financing and realistic tourism scenarios, we estimate the region’s financing gap at around $4 billion, or 4.8 percent of 2020 regional GDP. The ever-present risk of natural disasters could make it even wider.

Policy priorities

Avoiding the long-term effects and seizing the global recovery will require a nimble combination of short- and medium-term policies.