Washington, DC: On June 3, 2022, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation[1]with Bosnia and Herzegovina (BiH).

The war in Ukraine is casting a pall on the European economy, raising new challenges for BiH just as it rebounded from the Covid-19 pandemic. Spillovers from the war have materialized in a large increase in food and fuel prices and a deposit run on the two Sberbank subsidiaries operating in the BiH. Moreover, domestic political tensions, mainly regarding the role of state-level institutions, have weighed on investor sentiment and put on hold reforms to strengthen the single economic space and promote medium-term growth.

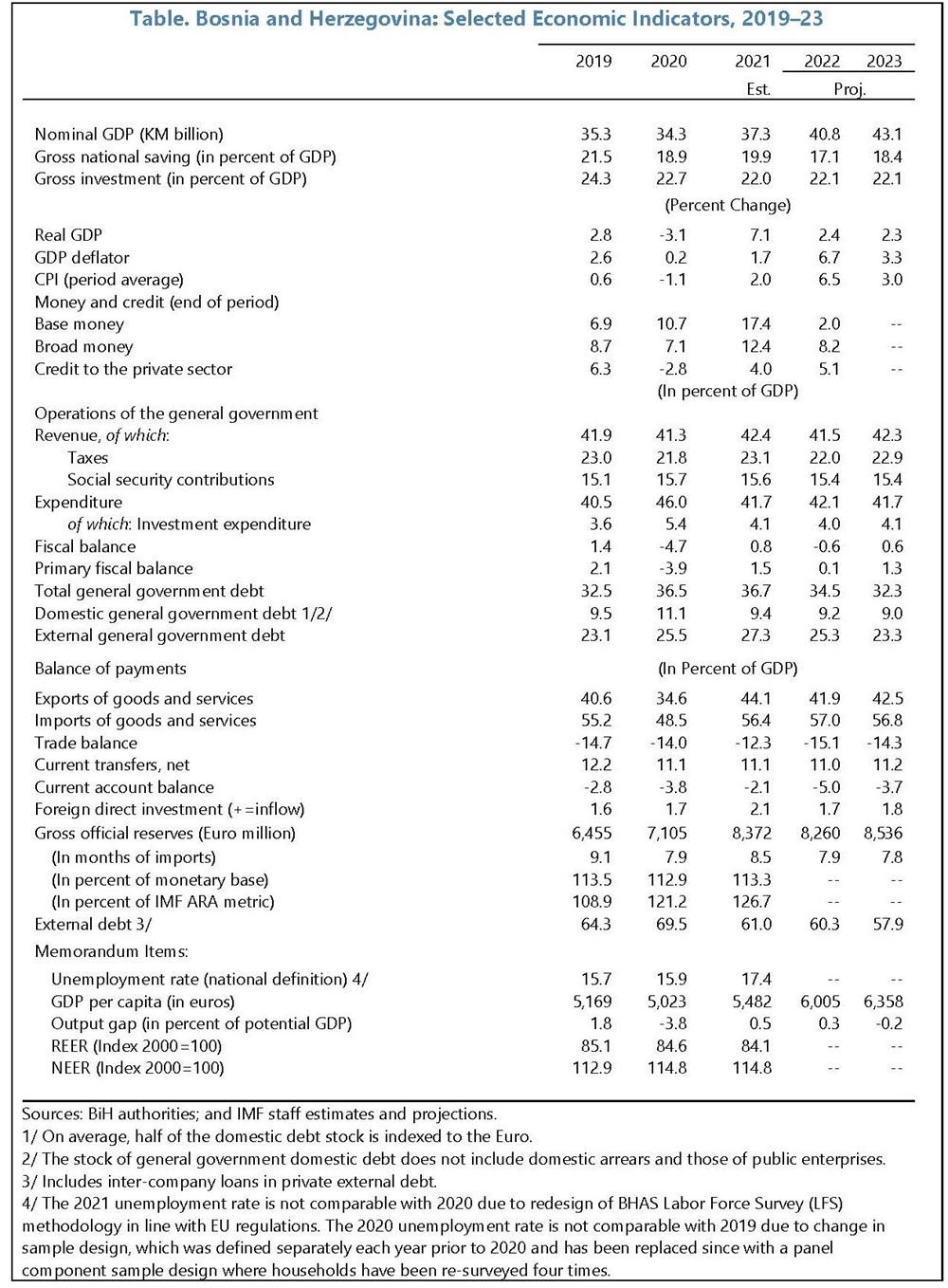

Growth is projected to decline to 2.4 percent in 2022, from 7.1 percent in 2021, and remain subdued in the medium term. Average annual inflation is expected to accelerate to 6.5 percent this year from 2 percent last year and soften gradually afterward. While the impact of the war in Ukraine on confidence and the financial sector in BiH appears now contained, BiH’s economy remains exposed to higher commodity prices, slower economic growth in Europe, and tighter financial conditions.

The fiscal position turned to a surplus of 0.8 percent of GDP in 2021 from a deficit of 4.7 percent in 2020. Revenues collected by the Indirect Tax Authority reached a record-high level last year, driven by rebounding private consumption and higher prices. External financing was also ample, including from the IMF and the European Union. The fiscal position is expected to register a small deficit in 2022 as the economy slows down and the authorities take expansionary measures to counter rising costs of living.

Executive Board Assessment[2]

Executive Directors welcomed Bosnia and Herzegovina’s economic rebound in 2021 spurred by stronger external demand and pent-up domestic demand. However, the spillovers of the war in Ukraine and underlying vulnerabilities will weigh on economic growth this year, while inflationary pressures have increased driven by large, imported energy and food price hikes. Looking ahead, determined policy and reform efforts, requiring greater political consensus, will be crucial to strengthen the single economic space and foster stronger sustainable growth.

Directors supported fiscal accommodation in response to inflationary pressures but urged the authorities to focus on targeted assistance to the most vulnerable. Directors generally considered that, absent a well-developed social safety net, a temporary suspension of fuel excises could be a second-best option. However, Directors recommended avoiding open-ended excise reductions, and generally cautioned against changes to the VAT system. Directors also advised the authorities to resist demands for non-targeted election-related spending and contain the relatively large public sector wage bill. Instead, they recommended scaling up public sector investment to boost growth over the medium term, preferably financed with low-cost loans from international financial institutions and accompanied by reforms to enhance investment implementation and efficiency. They also highlighted the importance of improving the social safety net.

Directors welcomed the authorities’ commitment to maintain the currency board and work to strengthen its resilience. They also underscored the need to enhance bank supervision to safeguard financial stability. While the banking sector has weathered the pandemic well and stabilized after the Sberbank crisis, vulnerabilities have been rising. Establishing a country-wide financial stability fund will be important to facilitate bank restructuring and provide liquidity in exceptional cases.

Directors stressed the need to fight corruption and resume and accelerate governance reforms, particularly to public procurement and the AML/CFT framework. They recommended establishing a single registry of bank accounts of individuals as a key AML/CFT tool and working toward publishing beneficial ownership information as part of reforming public procurement. They encouraged the authorities, in this context, to request an IMF governance diagnostic mission to help prioritize key areas for reforms. Directors also recommended enhancing public financial management and resuming work on the governance and transparency of public enterprises. They also highlighted the need to improve youth and women labor force participation and accelerate the transition to renewables and digitalization.

[1]Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

[2]At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country’s authorities. An explanation of any qualifiers used in summings up can be found here:https://www.IMF.org/external/np/sec/misc/qualifiers.htm.