Washington, DC: The Executive Board of the International Monetary Fund (IMF) concluded the 2022 Article IV consultation[1]with Burundi on July 20, 2022.

Burundi’s economy continues to navigate the challenging headwinds presented by the COVID-19 pandemic and the impact of the war in Ukraine. Prior to the pandemic, the country was recovering from an economic and political crisis following late President Nkurunziza’s decision to run for a third term in 2015. The war in Ukraine has disrupted the recovery momentum, with the associated higher import prices (food and fuel) and lower export prices (tea and coffee) and supply chain bottlenecks amplifying inflation pressures and external sustainability challenges. At the same time, the country is benefiting from the positive effects of the recent reengagement with the international community, the lifting of E.U. and U.S. sanctions at end 2021/early 2022, and ending of mandatory reporting by the U.N. Security Council. The 2022 Article IV Consultation seals the full reengagement with the IMF-the last Consultation was concluded in 2014.

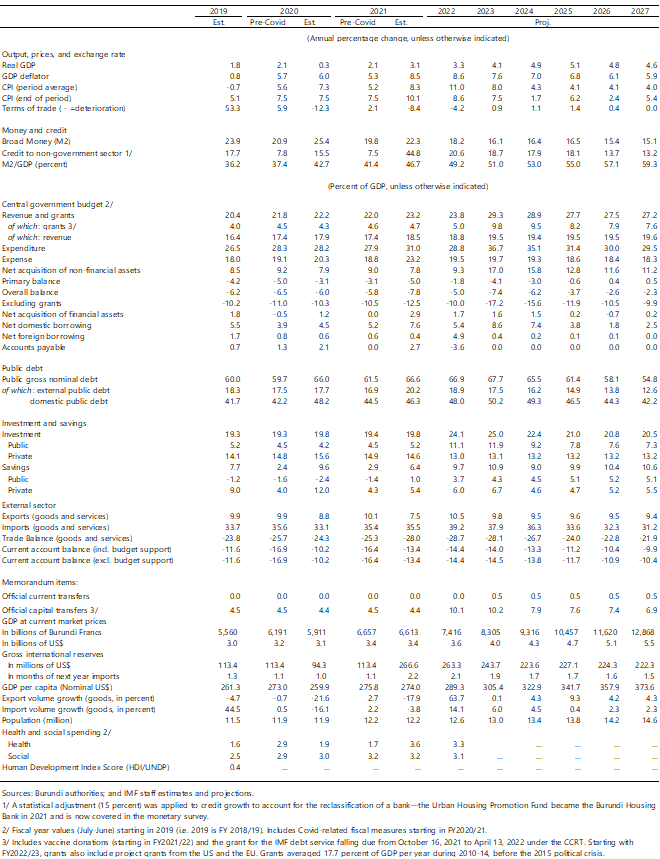

Growth is expected to pick up to 3.3 percent in 2022, slightly strengthening from 3.1 percent in 2021, and average about 4.7 percent over 2023-27 (Table 1), benefitting from ongoing investment, plans to further scale up public investment, and ongoing reforms under the Plan National de Development (PND). Downside risks are notable, stemming from uncertainty around the duration and impact of the pandemic and spillovers from the war in Ukraine. These risks are however partly offset by significant upside risks linked to the recent announcement of grants to help Burundi cope with the external shocks, the full potential of the reengagement with the international community, and the end of mining contract negotiations, which would alleviate balance of payment pressures and boost economic growth. Inflation is expected to rise to double digits in 2022, and subsequently subside. The fiscal deficit would level off at around 5 percent of GDP in 2021/22, lower than during the peak of the pandemic (7.8 percent of GDP in 2020/21).

Burundi’s public debt is sustainable; however, the risk of external debt distress is high. External imbalances are large, with reserve coverage below adequacy levels and a large parallel exchange rate market premium.

Executive Board Assessment[2]

Executive Directors agreed with the thrust of the staff appraisal. They welcomed the authorities’ policy response to the COVID-19 pandemic and steps taken to address the spillovers from the war in Ukraine, including inflationary pressures. Directors highlighted that growth is expected to continue to strengthen, subject to important risks. They underscored the need for an ambitious and broad-based set of policies to address debt vulnerabilities and external imbalances and for reforms to address the roots of fragility, unlock bottlenecks, and ensure inclusive growth. Directors emphasized the importance of durable political and social stability and welcomed the authorities’ efforts to reengage with the international community.

Directors welcomed Burundi’s commitment to revenue-led fiscal consolidation and prudent borrowing, noting that while debt remains sustainable, the risk of external debt distress is high. They underscored the need to enhance domestic revenue mobilization through digitalization and measures to widen the tax base. Directors welcomed the focus on protecting priority COVID-19-related investment and social spending, including on health and education. They emphasized the importance of rationalizing spending and strengthening public financial management.

Directors highlighted the weak external position and stressed the need for measures to address external imbalances and rebuild reserves. In this context, they saw merit in using the SDR allocation primarily to bolster reserves. Directors underlined the importance of modernizing the monetary policy framework, and welcomed the authorities’ commitment to design a reform strategy to unify the official and parallel market exchange rates, supported by Fund capacity development. Noting the ongoing inflationary pressures and rapid credit growth, Directors underscored the need for a well-timed recalibration of the monetary policy stance and for steps to reduce monetary financing and strengthen the independence of the central bank. They recommended remaining vigilant to financial sector risks and adjusting policy as needed.

Directors called for reforms to address fragility, enhance competitiveness, and strengthen governance. They emphasized the need for measures to improve human capital, enhance productivity, and reduce the vulnerability to climate-related shocks. Directors encouraged measures to ensure transparency on the use of COVID-19-related spending. They stressed the importance of collecting and publishing information on the ultimate beneficial ownership of companies that were awarded COVID-related contracts. Directors called for steps to align the AML/CFT framework with international standards and for quick implementation of requirements to gain full membership in the Eastern and Southern Africa Anti-Money Laundering Group.

It is expected that the next Article IV consultation with Burundi will be held on the standard 12-month cycle.

[1]Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

[2]At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country’s authorities. An explanation of any qualifiers used in summings up can be found here:https://www.IMF.org/external/np/sec/misc/qualifiers.htm.